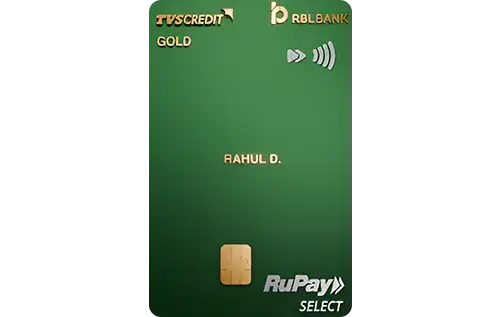

TVS Credit RBL Bank Gold Credit Card

Features, Fees, & Benefits

Joining Fees

Rs. 1,599 + GST

Renewal Fees

Rs. 1,599 + GST

Movie & Dining : 5% cashback upto 250 on EazyDiner.

Rewards Rate : 10 RP for every 100 spent on international purchases; 2 RP for every 100 spent on everyday transactions

Reward Redemption : All the RP can be redeemed for vouchers and gift cards on the RBL Rewards Portal; 1 RP = 0.25

Domestic Lounge Access : 1 complimentary domestic airport lounge access every quarter

International Lounge Access : 1 complimentary international airport lounge access every quarter

Other Details

Complimentary lounge access per quarter for domestic and international lounges.

This card offers NCMC benefits along with easy payments through UPI linking.

Milestone benefits are also included with this card, along with a fuel surcharge waiver.

TVS Credit RBL Bank Gold Credit Card: Everything You Need to Know about Features, Benefits, and Application

Over time, the credit card has changed, shifting from a straightforward payment product into something that offers rewards, benefits, and essentially a lifestyle. The TVS Credit RBL Bank Gold Credit Card is one such premium card that intends to bring a combination of lifestyle, travel, and financial benefits. Perhaps you travel often, shop frequently, or love to eat out, this credit card takes the cake.

In this write up, we will take an in-depth look at what all this card has to offer, the benefits, charges, eligibility; and everything else that you should know, in order to help you make up your mind.

TVS Credit RBL Bank Gold Credit Card Details

Summary of the TVS Credit RBL Bank Gold Credit Card

The TVS Credit RBL Bank Gold Credit Card is a credit card that has been brought to you by TVS Credit Services together with RBL Bank. It’s built for those who want to score lifestyle bonuses and benefits with every swipe. Complete with an array of benefits such as dining privileges, travel rewards, golf lessons and offers on top hotels and resorts, it is for the individuals who wish to make everything count with every spend.

Top Highlights of the TVS Credit RBL Bank Gold Credit Card

We will accept the fact that the TVS Credit RBL Bank Gold Credit Card is loaded with many features, but before we move on to the benefits, let’s understand what makes this card different from the rest in the business:

Joining and Renewal Fee

Joining Fee: ₹1,500 + GST

Renewal Fee: ₹1,500 + GST

This fee grants you access to an impressive suite of perks, including reward points and travel credits.

Reward Points

It’s reward points system is one of the major turn-ons of the TVS Credit RBL Bank Gold Credit Card:

2 Reward Points per ₹100 on domestic transactions

10 Reward Points on every ₹100 on international spends

The card is most rewarding compared to local and international spends. In store or around the world, the card rewards you with valuable Miles for every purchase.

Reward Redemption

There are various ways to redeem the reward points:

1 Reward Point = ₹0.25 on hotel and flight bookings.

For Redeeming vouchers, gift cards or merchandise, 1 Reward Point = ₹0.10

This versatility makes the reward points system a little more helpful as you can use it to cut price on travel, shopping, and even food.

Benefits and Features of the TVS Credit RBL Bank Gold Credit Card

There is much more to the GV RBL Credit Card than just reward points - in a nutshell, if you are looking for a card with a general rewards program, low fees, and some other premium-card-type benefits, then you should definitely consider the RBL credit card.

Dining Benefits

TVS Credit RBL Bank Gold Credit Card Dining is one of the luxuries of life that the TVS Credit RBL Bank Gold Credit Card improves upon with multiple dining benefits:

5% Cashback on EazyDiner: The card provides some relief on your monthly spend at restaurants, providing ₹250 cashback on spends through EazyDiner every month. Whether you’re just picking up lunch or treating yourself to a fancy dinner, the card offers rewards for diners at participating restaurants.

This benefit is especially nice for all those who like to eat out or travel and will make your dining experiences a bit more pleasurable with some of the savings.

Travel Benefits

For travellers Greycharge offers a number of travel benefits that make your journey comfortable and renders it to be more rewarding with TVS Credit RBL Bank Gold Credit Card.

Domestic Lounge Access: Get 1 free visit per quarter on spending ₹50,000 in a quarter. This benefit increases even more to two free visits a quarter when you enable ₹75,000 or more in the same period.

International Lounge Access: The card provides 1 free lounge access per quarter on spending ₹1,00,000 in a quarter. This is a fantastic benefit for those of you who travel internationally frequently and like to chill out in lounges while traveling.

Railway Lounge Access: Enjoy complimentary railroad lounge visit once in a quarter, 1 visit per quarter (you need to be a frequent train traveler and prefer lounges due to connectivity issues around them) with the TVS Credit RBL Bank Platinum Maxima Credit Card.

These travel perks make the card a perfect sidekick for domestic and overseas travels alike.

Golf Benefits

It is a provision on TVS Credit RBL Bank Gold Credit Card that cardholders get 4 rounds of free green fees in a year at selected golf courses. The card also comes with 1 free golf lesson per month so it’s perfect if you like golf or want to learn.

No matter if you’re a veteran golfer or new to the game, the card adds value to your game by providing access to more than a dozen exclusive golf offers.

Fuel Benefits

The card also provides for a fuel surcharge waiver:

1% Fuel Surcharge Waiver: Avail a 1% waiver on fuel purchases between ₹400 and ₹5,000, across all petrol pumps in India. This perk could save you money on fuel if you drive a lot.

Insurance Coverage

The TVS Credit RBL Bank Gold Credit Card comes with insurance covering different aspects of a card member’s life to give you peace-of-mind when you’re in need some backup.

Purchase Protection: If an eligible purchase is stolen or damaged within a certain time frame, you’ll be reimbursed for the loss or damage.

Credit Shield: In the event of the cardholder's unexpected death, the balance on the card is paid off.

This insurance will give you peace of mind and add more value to the card.

Fees & Charges

Now, we will closely examine the different fees and charges of the TVS Credit RBL Bank Gold Credit Card:

Joining Fee: ₹1,500 + GST

Renewal Fee: ₹1,500 + GST

Fuel Surcharge: 1% surcharge on fuel transactions from ₹400 to ₹5,000

Cash Advance Fee: 2.5% of the Cash Withdrawal amount (minimum ₹500)

Late Payment Fee: Ranges from ₹100 to ₹1,300 depending on the balance_due amount

Reward Redemption Fee – ₹99 + GST will be charged per redemption

Those are very typical fees for a card like this, and offer a lot of value when taken into account all the benefits you get.

Eligibility Criteria

Age: Candidate between age 21 years to 70 years are eligible.

Income: Applicants should be earning a minimum of ₹3 lakh per annum.

Decent Credit: You need a decent credit score to get approved. Most credit cards require this to be 750+.

Such a card is very easy to apply for and, particularly if you meet the age and income criteria and have a good credit history, you could be enjoying the benefits of the card in no time.

Why Should You Go for the TVS Credit RBL Bank Gold Credit Card?

Comprehensive Rewards System

TVS Credit RBL Bank Gold Credit Card has an impressive points system, for online and offline spending. You can get 10 Points for every ₹100 on international spend and 2 Points for every other ₹100 and is a good option for someone who wants an all-rounder rewards card.

Travel and Lifestyle Perks

The card features some pretty sweet travel benefits, such as lounge access in the US and internationally as well as golf and dining credits. It is an attractive choice for both business travelers and those who enjoy outdoor activities such as golf.

Affordable Fees

It has moderate joining and renewal fees of ₹1,500 + GST among premium credit cards in the market. The card also comes with various ways to avoid these fees, such as spending a certain amount on retail purchases.

Insurance and Protection

The card additionally features important insurance benefits such as Purchase Protection and Credit Shield insurance to give cardmembers peace of mind.

Final Thoughts

The TVS Credit RBL Bank Gold Credit Card is a good option for those who want a credit card with a good blend of lifestyle, travel and financial offers. Along with a very generous rewards program, free lounge access and golf benefits and included insurance cover, this card offers fantastic value to those that use it frequently.

This card is an optimal choice based on your spending habits whether you’re a miles collector, a dining lover, or golfer so you maximize your spending. The TVS Credit RBL Bank Gold Credit Card helps you do just that as well as add value to your daily spend.

If you are looking for a credit card that comes with luxury benefits along with rewards it is certainly worth checking out the TVS Credit RBL Bank Gold Credit Card.

Download Finckr App

Effortlessly apply for India's top credit cards through a secure and user-friendly platform right at your fingertips.

Find the perfect card by comparing features, rewards, and benefits side by side & Get personalized card recommendations tailored to your spending habits.

Add your credit cards to stay updated on benefits, rewards, and exclusive offers. Never miss out on perks and updates tailored to your cards!