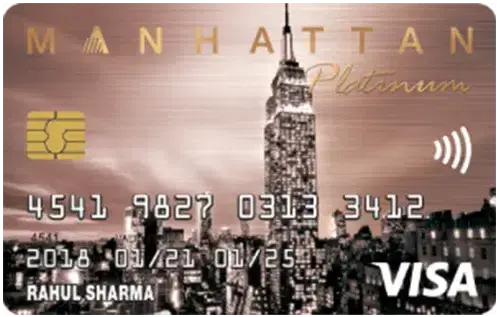

Standard Chartered Manhattan Credit Card

Features, Fees, & Benefits

Joining Fees

Rs. 999 + GST

Renewal Fees

Rs. 999 + GST

Rewards Rate : 3 Reward Points per Rs. 150 you spend, and 5% cashback on departmental stores, groceries, and supermarkets.

Reward Redemption : The earned reward points are redeemable on the 360-degree Rewards portal. Here, 1 RP = Rs. 0.25.

Other Details

Welcome benefit of 5,000 bonus Reward Points.

Get a 5% cashback on groceries, departmental stores, and supermarkets.

Get 3 Reward Points on every other purchase of Rs. 150.

Renewal fee waiver on spending Rs. 1,20,000 or more in the preceeding year.

Easy Reward redemption through the 360-degree Rewards portal.

Standard Chartered Manhattan Credit Card: Features, Benefits, and Application Guide

The Standard Chartered Manhattan Credit Card is exceptional among premium cards for its attractive rewards programme, lifestyle benefits and a list of features that are designed to meet the needs of urban professionals. This card is good for people who want to maximize their everyday spending, specifically on shopping, dining, and entertainment.

Want to earn rewards on all your spends or exclusive offers at top retail outlets, the Standard Chartered Manhattan Platinum Credit Card is just what you need. This post takes a closer look at the pros and cons of this premium credit card including its features, rewards, fees, and application requirements. Keep reading to find out if the Manhattan Card is the right fit for your wallet.

Summary of the Standard Chartered Manhattan Credit Card

The Standard Chartered Manhattan Credit Card is aimed at appeal to the requirements of today’s consumer, who wants a card that returns back for your spending. With enhanced points earning, exclusive dining benefits and an attractive cash back, this card is an optimal choice for heavy shoppers, diner- outers and travelers. With various rewards options and lifestyle perks, this card provides good value to cardholders.

Standard Chartered Manhattan Credit Card Highlights

Some of the salient Features of the Standard Chartered Manhattan Card etc.

But before we start getting into the nuts and bolts of what the card offers, here are some of its key characteristics that set it apart:

Annual Fee

What is the joining fee of the Standard Chartered Manhattan Credit Card?

The renewal fee is also ₹1,000 + applicable taxes that can be reversed if you reach the spends threshold as mentioned.

Reward Points System

- The card rewards with 5 Reward Points on every ₹150 spent on Dining, Groceries and Departmental Stores.

- It also gets you 1 Reward Point for every ₹150 spent elsewhere (fuel, utilities, or anything else)

- The reward points can be used to purchase merchandise, experiences, vouchers, etc. from the rewards catalog of the card.

Cashback

The Manhattan Credit Card gives you a 10% cashback on the Standard Chartered partnered stores in top brands, especially during offers. Great chance to save money on these fabulous range of comfortable shoes.

Exclusive Dining Offers

Membership provides cardholder with exclusive discounts and promotional deals at nationwide restaurants and food chains. Dine-in memberships may offer a percentage off the total bill or deals for groups.

Fuel Surcharge Waiver

Get a 1% fuel surcharge waiver on fuel transactions with petrol, a great way to save over the long run especially if you use your card for a high number of fuel transactions.

Features of the Standard Chartered Manhattan Credit Card

So what are the benefits of the Standard Chartered Manhattan Card. Let’s take an even closer look at the massive benefits of the Standard Chartered Manhattan Credit Card and find out why the credit card is ideal for those who not only want the best in terms of reward points and benefits.

Bonuses and Points – Stretch your budget to the max

The Manhattan Credit Card is a great card for the handsome rewards program it has to offer. You earn 5 Reward Points for every ₹150 you spend on dining / departmentstore / grocery store spends on your birthday (however, you don’t get these Reward Points for online spends) – not very good, but woild do. It is no wonder then that the card is a boon for people who love to shop or dine out.

And for all other spends, you get 1 Reward Point for every ₹150 you spent -- so every swipe adds to your reward points. These points are subsequently redeemable for a variety of merchandise and services, such as airline tickets, hotel rooms, electronics or gift certificates from major retailers.

Tip: If you want to make the most of your points, use the Manhattan Credit Card for your daily purchases such as groceries, dining out, and fuel. You can earn points fast when you know how to strategically earn and redeem them for useful goods and services.

Cashback Offers – More Saving on Your Shopping!

If you are an individual who enjoys shopping at some of the partner outlets, then the Manhattan Credit Card is going to be of great interest to you, as you stand to receive Use the Manhattan Credit Card app and save while you earn. The card comes with 10 percent cashback on specific retail stores and e-commerce sites. That includes purchases you make during special promotions, which can help you save even more.

The card also provides cashback on a number of other categories, further leveling up your spending game. Watch for seasonal offers or partner deals where you can save money while earning cashback on everyday buying.

Dining Perks – Various offer on Top Restaurants

Eating out is second nature to most and Standard Chartered Manhattan Credit Card understands this very well - Enter exclusive dining privileges. The cardholder is entitled to exclusive discounts and deals at a variety of restaurants, cafes and food joints, across the country.

These dining deals might come in the form of food and drinks discounts or group-savings promotions. Be it a dinner for two or high tea with friends, with the Manhattan Credit Card your meals just became more delicious.

Fuel Surcharge Waiver – Enjoy Fuel Transactions on the card

Gas is one of the most common costs for car owners, and saving money on gas costs can be a huge advantage. The Standard Chartered Manhattan Credit Card provides for 1% fuel surcharge waiver on all fuel transactions from ₹400-₹5,000. That means you can bank some fuel savings every time you top up to significantly lower your fuel costs overall.

This doesn’t sound like a lot, but it can really add up – especially for those using their car frequently and for many fuel transactions.

Complimentary Access to Airport Lounges

The card also offers free access to certain lounges at airports as a freebie. Airport lounge access is a privilege for the regular flyers and there is indeed a lot of pleasures to enjoy: to relax in a comfortable seat prior to the flight, to munch into the free snacks, and sip on delicious beverages.

With its Manhattan Credit Card, cardholders will have access to lounges for free at major domestic airports to relax before boarding their flight. This is especially useful for travel addicts both business and pleasure related.

Other Benefits of the Standard Chartered Manhattan Credit Card

Decreased Interest Rates and Payment Option Choices

If you are a cardholder who has to carry a balance from month to month, you will enjoy competitive interest rates on the Manhattan Credit Card. You have the flexibility of making payments through EMIs on our site for purchase over Rs. 4000.

… With this flexibility, you can better manage your finances and maximize the value you receive from using the card.

Contactless Transactions – Time to Tap and Pay

The Manhattan Credit Card also features contactless payment technology, for fast and secure payments -- all you have to do is tap your card on a point-of-sale (POS) terminal! This feature is extremely handy, particularly for tiny purchases like coffee, snacks, or groceries.

Contactless payment also decreases reliance on PIN numbers and signatures, expediting the checkout and creating a smoother shopping experience.

Standard Chartered Manhattan Credit Card Eligibility Criteria

You are eligible to apply for Standard Chartered Manhattan Credit Card if you have:

- Age: 21 to 60 years of age.

- Income: The lowest annual income requirement depends on whether the applicant is employed.

- Salaried people need to have a minimum ₹30,000/per month income

- Self-employed should be able to show a consistent income of ₹6 lakhs a year.

- Credit Score: Many lenders prefer a good to excellent credit score to increase your odds of approval.

Conclusion: Should You Apply for Standard Chartered Manhattan Credit Card?

The Standard Chartered Manhattan Credit Card is a good all round credit card that comes with strong rewards, dining and shopping privileges. Whether you’re a big spender, a foodie or a frequent flyer, this card spends where it counts.

The Manhattan Credit Card offers you a plethora of benefits, ranging from attractive reward points, convenient cashback’s to great extras, like dining and fuel advantages. Factor in the free lounge access or the flexible payment opportunities, and it’s apparent this card is solid competition in the realm of premium credit cards.

If you are looking for a card that offers benefits on daily spend while offering top-end benefits on travel, dining and entertainment, then look no further – Standard Chartered Manhattan Credit Card is the one for you!

Similar Cards

Download Finckr App

Effortlessly apply for India's top credit cards through a secure and user-friendly platform right at your fingertips.

Find the perfect card by comparing features, rewards, and benefits side by side & Get personalized card recommendations tailored to your spending habits.

Add your credit cards to stay updated on benefits, rewards, and exclusive offers. Never miss out on perks and updates tailored to your cards!