InterMiles ICICI Bank Coral Credit Card

Features, Fees, & Benefits

Joining Fees

Rs. 1,250 + GST

Renewal Fees

Rs. 1,250 + GST

Movie & Dining : 25% discount up to Rs. 100 on purchase of movie tickets twice a month from BookMyShow, exclusive and exciting benefits on dining under ICICI Bank Culinary Treats Program.

Rewards Rate : 3 Intermiles on Rs. 100 spent on the American Express variant and 2 Intermiles per Rs. 100 spent on the VISA variant, 6 InterMiles on every Rs. 100 spent on booking revenue airline tickets at intermiles.com on American Express variant and 5 InterMiles per Rs. 100 on VISA variant.

Reward Redemption : The accumulated InterMiles can be further redeemed for booking flights and hotels through www.intermiles.com, for purchasing gift vouchers, fuel, etc. 4 InterMiles are equivalent to Re. 1 (only applicable for fuel purchase).

Travel : Complimentary domestic lounge access.

Domestic Lounge Access : You get 2 complimentary access to domestic lounges per quarter ( 1 each on VISA and American Express Variant).

Other Details

Get 2,500 bonus InterMiles and flight & hotel discount vouchers worth Rs. 750 as welcome benefits.

Get 1,250 bonus InterMiles every year as a renewal benefit.

Earn up to 7.5 InterMiles on a minimum spend of Rs. 100 for booking Etihad flight tickets through www.intermiles.com.

Earn accelerated InterMiles on flight and hotel booking from www.intermiles.com.

Get complimentary access to a domestic airport lounge every quarter.

A discount of up to Rs. 100 on movies on BookMyShow.

15% or more discount on dining.

1% fuel surcharge waiver.

The Ultimate Guide to the InterMiles ICICI Bank Coral Credit Card: Features, Benefits and How to Make the Most of Rewards

Credit cards have transformed far beyond a simple shopping tool in today’s day and age. These cards offer a variety of different rewards, perks, and features that were intended to make your life easier, more convenient, and ultimately… more lucrative. Whether it's racking up travel miles or cashback at the end of the month, credit cards have evolved to be important pieces to managing everyone's everyday money.

There is one such credit card which has caught the attention of everyone due to its blend of travel, lifestyle and dining benefits – the InterMiles ICICI Bank Coral Credit Card. This card is brought to you by ICICI Bank in association with InterMiles and is suited for those who wish to earn travel miles and other benefits such as dining offers, lounge access etc. If you travel frequently, love food, or have an affinity for the finer things in life, then this card has something for you.

In this detailed guide, we’ll be looking at the features, benefits, fees, rewards program, and other aspects to if the InterMiles ICICI Bank Coral Credit Card is suitable for you.

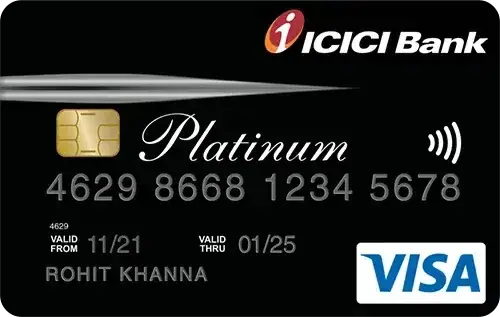

Overview of the InterMiles ICICI Bank Coral Credit Card Design:

What sets it apart?

The InterMiles ICICI Bank Coral Credit Card is a co-branded credit card that comes with a range of rewards and benefits. It’s the card that is made for people seeking to acquire travel miles and bask in upscale lifestyle perks. Whether it is booking a flight, dining at your favorite restaurant, or shopping for your necessities, your card will help you earn InterMiles on every spend that you can redeem later for flights, hotel stay and more.

Card is provided by InterMiles, one of India’s leading frequent flyer program. InterMiles enables to you earn and spend miles across a wide range of airlines, hotels, dining, and other partner brands. That’s why the InterMiles ICICI Bank Coral Credit Card is must-have for those who fly often and love to earn miles with least effort.

Salient Features of the InterMiles ICICI Bank Coral Credit Card

But before we get to the benefits here is a quick look at the features which makes the InterMile ICICI Bank Coral Credit Card a prime offering:

Joining and Renewal Fees:

- Joining Fee: ₹1,250 + GST

- Renewal Fee: ₹1,250 + GST (waived off on annual spends of ₹1,00,000)

Reward Points System:

- 8 InterMiles / ₹100 on online transactions (excluding EMIs).

- 2 InterMiles/₹100 on other retail spends (except EMI transactions, fuel, insurance, and utilities).

- Bonus Miles : 6 InterMiles per ₹100 spent on Etihad flight bookings.

Welcome Benefits:

- Welcome bonus of 2,500 InterMiles on your first spend.

- Discount Coupons: Get ₹750 off on flight and hotel booking.

Dining Benefits:

- 25% off at certain restaurants under the ICICI Bank Culinary Treats Programme.

Airport Lounge Access:

- 1 free domestic airport lounge visit per quarter (4 per year).

- 1 free visit at railway lounges every quarter.

Fuel Surcharge Waiver:

- Waiver of 1% fuel surcharge on fuel transaction between ₹500 and ₹4,000 at any HP pump.

Insurance Coverage:

- Purchase protection and accidental insurance coverage are among these complimentary benefits, extending added value to items you buy each day.

InterMiles ICICI Bank Coral Credit Card – Benefits

The InterMiles ICICI Bank Coral Credit Card comes with the following benefits:

Welcome Benefits

InterMiles Welcome Offer: Earn 2,500 InterMiles on payment of joining fee for the card and using it at least 1 transaction (valid from 15th July, 2021).

InterMiles ICICI Bank Coral Credit Card is a loaded crotcheted number that offers exciting privileges for frequent travelers, food connoisseurs, and lifestyle enthusiasts. Here is a closer look at what the most important benefits are.

Earning InterMiles on Every Spend

The best part about InterMiles ICICI Bank Coral Credit Card is that it enables you to earn InterMiles on all purchases made. Whether you are online shopping or dining out at restaurants or booking flights, you can earn miles on every purchase.

- 8 InterMiles per ₹100 on online spends, ideal for those who shop or book services online often.

- 2 InterMiles per ₹100 on your spending for all other spends.

And the best part is that InterMiles can be cashed in on flights, hotel stays and at partner stores, so it’s one of the most flexible rewards programs on the market.

It’s like you’re earning travel miles for things you’re already spending on, and those miles can add up over time to free or discounted travel, something that an experienced traveler can certainly cheer.

Welcome Benefits and Bonus Miles

On applying for the InterMiles ICICI Bank Coral Card, earn an attractive welcome bonus of 2,500 InterMiles. This provides you a decent way to get started with the InterMiles program. You’ll also get a variety of other perks through the year, including discounts on flight and hotel bookings, so you can extract plenty of value from the card from day one.

Travel Benefits: Lounge Access & More

Definitely for those who love to travel, the InterMiles ICICI Bank Coral Credit Card comes with great benefits:

Free Lounge Access:

Avail 1 complimentary domestic lounge visit per quarter (you can only claim 4 times a year). You can relax in comfortable surroundings with gourmet food, drinks and Wi-Fi while waiting for your flight in airport lounges. This is especially useful for those who travel regularly.

Railway Lounge Access:

You can visit a railway lounge 4 times a year apart from the airport lounges.

Fuel Surcharge Waiver:

Card offers a 1% waiver on fuel surcharge between ₹500 and ₹4,000 at all HPCL pumps. If you are someone who drives a lot and uses fuel cards a lot, this is a great advantage.

Dining Benefits

Exclusive dining privileges with InterMiles ICICI Bank Coral Credit Card:

- 25% off at partner restaurants under culinary treats program by ICICI Bank.

- More than 2500 restaurants throughout India has opted for this program where food will be cheaper to afford for food enthusiasts.

Those discounts can really start to add up, especially if you are someone who eats out frequently or you like to try new places around the city.

Purchase Protection and Insurance

This card gains added protection on your purchases to give you peace of mind. Whether it’s a new phone, laptop or any other item you purchase, the purchase protection will keep your eligible purchases covered against damage, theft and loss.

And with accidental insurance coverage scheduled to the primary card holder, you can rest assured that you and your family will be safe knowing you are covered financially in case of accidents.

Flights, Tickets, and More Reward Redemption

The InterMiles accrued on your InterMiles ICICI Bank Coral Credit Card are extremely versatile. You can redeem them for:

- Flights: Redeem your InterMiles to choose from a range of airline partners.

- Hotels: Stay with the program’s hotel partners or redeem miles for savings.

- Shopping: You can spend your InterMiles on shopping at partner stores, offering lots of choice for how to use your rewards.

That’s what makes the InterMiles ICICI Bank Coral Credit Card a very versatile card to have for anyone looking to add value to their travel expeditions from booking flights, to having places to stay or even while shopping for new products.

Fees and Charges

Anyone who is considering applying for any credit card needs to know what any fees and charges are going to be. Now let me provide you a brief overview of the fees and charges associated with the InterMiles ICICI Bank Coral Credit Card:

- Joining Fee: ₹1,250 + GST

- Renewal Fee: ₹1,250 + GST

Late Payment Fee:

- Less than ₹100: Nil

- ₹100 - ₹500: ₹100

- ₹500 - ₹5,000: ₹500

- Above ₹5,000: ₹750

Interest Rates:

The card charges an interest rate of 3.5% per month (42% per annum) for the remaining amount.

Foreign Currency Markup:

3.5% over and above while doing international transactions

Fuel Surcharge:

1% surcharge across all fuel stations at HPCL outlets with a maximum of ₹250 per statement cycle

Eligibility Criteria

To avail the InterMiles ICICI Bank Coral Credit Card you will have to fulfil some of the eligibility factors:

- Age: 21 to 65 years old.

- Income: For salaried applicants, the minimum monthly income should be at least ₹30,000, and for self-employed applicants, there are other income criteria.

- Credit Score: A good credit score, minimum of 750 is required to get approval for this card.

Bottomline: Should you go for the InterMiles ICICI Bank Coral Credit Card?

The InterMiles ICICI Bank Coral Credit Card is also ideal for anyone looking to earn benefits as they go about their daily expenses, all while enjoying an exclusive lifestyle and travel privileges. Whether you’re traveling, dining, or shopping, the Gold Card rewards you for doing what you love, and with more perks than ever before you will enjoy flying to the top faster than ever.

Featuring an exciting rewards points program, travel privileges, dining benefits and purchase cover, the InterMiles ICICI Bank Coral Credit Card is great value for the frequent commuter and the beauty conscious traveler. If you’re the kind of person who is looking to maximize your spending with a card that comes with lots of perks, then definitely consider this one.

If you are looking to maximize your spends and reward yourself with great travel benefits, apply for the InterMiles ICICI Bank Coral Credit Card today and start earning rewards!

Download Finckr App

Effortlessly apply for India's top credit cards through a secure and user-friendly platform right at your fingertips.

Find the perfect card by comparing features, rewards, and benefits side by side & Get personalized card recommendations tailored to your spending habits.

Add your credit cards to stay updated on benefits, rewards, and exclusive offers. Never miss out on perks and updates tailored to your cards!